Bank of Canada expected to cut mortgage rate to near record low

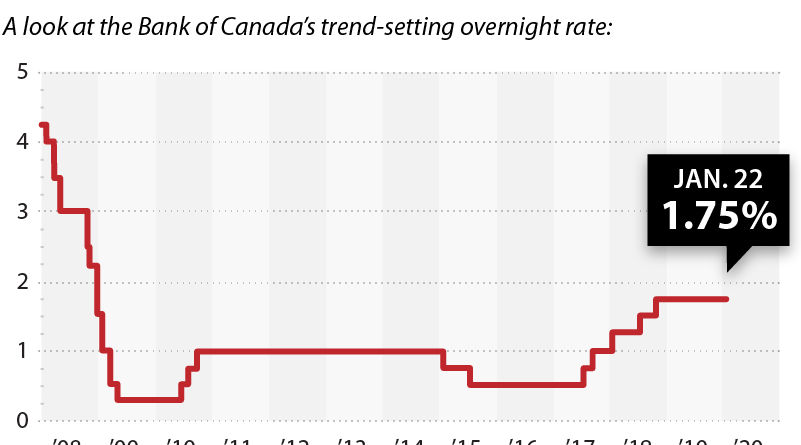

[News 1130 - August 11, 2020] VANCOUVER (NEWS 1130) — Mortgage rates could near a record low as experts expect the Bank of Canada to cut its five-year mark as soon as this week. CIBC and BMO both cut their five-year mortgage rates by 15 basis points earlier this week to 4.79 per cent. The Canadian Mortgage Brokers’ Association expects an imminent cut to the benchmark five-year rate, as well. The Bank of Canada is expected to reduce the benchmark qualifying rate from [...]