Will Vancouver recover from ‘policy shock’?

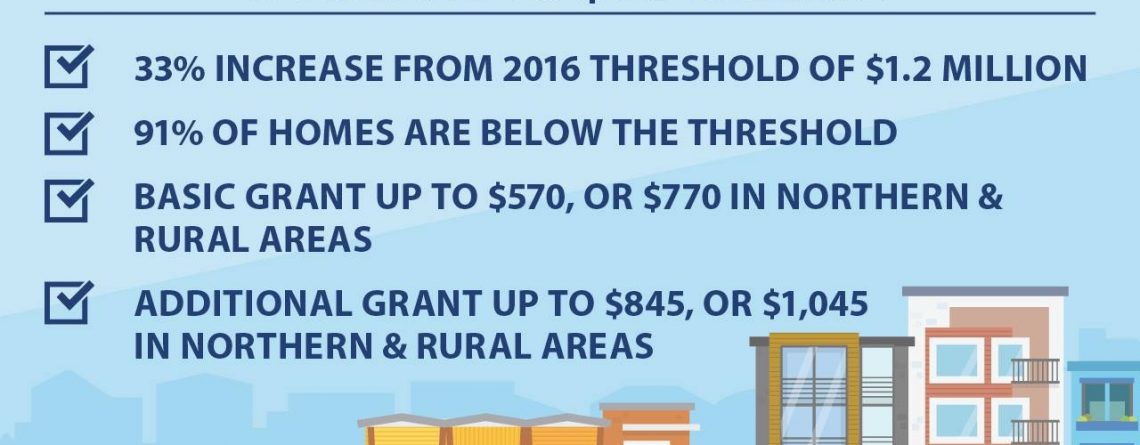

[By: Chana Fay Charach, February 8, 2017] Vancouver is one of the most watched real estate markets in Canada and possibly internationally as well. Over the last couple of years, we have experienced extraordinarily heated conditions to say the least. Not only was there a rapid rise in values in many areas but also a significant number of sales. However, in the later part of 2016, things cooled off after numerous government policy changes were implemented. “From a real estate perspective, [...]