Bank of Canada holds interest rate steady but some suggest a rate cut could be back on the table

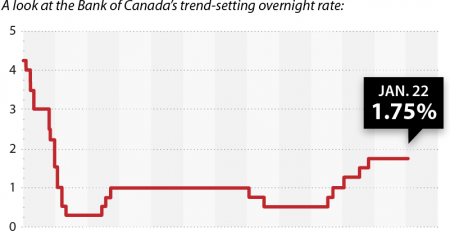

Canada’s central bank has decided to keep its benchmark interest rate at 1.75 per cent, and says the timing of possible future hikes has become increasingly uncertain.

The Bank of Canada says the economic slowdown that began at the end of last year is a bit worse than it was expecting, including a sharper-than-anticipated slowdown in Canada’s oil patch. The bank also singled out softness in the housing market and consumer spending as reasons for a gloomier outlook.

“It is clear that global economic prospects would be buoyed by the resolution of trade conflicts,” the bank said.

“With increased uncertainty about the timing of future rate increases, [the bank] will be watching closely developments in household spending, oil markets, and global trade policy.”

The bank meets eight times a year to set its interest rate, which filters down into the rates that Canadians get on things like savings accounts and mortgages.

James Laird, co-founder of rate comparison website Ratehub Inc. and president of mortgage broker CanWise Financial, said that reading between the lines of the bank’s decision on Wednesday suggests their concern over the economy could temporarily override their desire to see higher interest rates.

“The softening rate outlook will put downward pressure on bond yields, causing fixed rates to drop as we enter the spring homebuying market,” Laird said.

“Overall, this announcement will be helpful to first-time homebuyers looking to enter the housing market this spring.”

TD Bank economist Brian DePratto has a similar view, suggesting the bank’s statement makes it clear that “unless we see a robust growth recovery mid-year … further rate hikes in 2019 are all but off the table.”

“The core message today appears to be that the economy requires more stimulus than previously thought,” DePratto said.

Royal Bank economist Dawn Desjardins said “the bank did not dispense with the prospect that interest rates will rise in the future,” noting that she thinks they could come once the temporary slowdown in energy has passed.

“[But] no rate increase is likely until the second half of the year,” she said.

Bank of Canada governor Stephen Poloz is next scheduled to meet with other members of the bank’s governing council and reveal their decision on where to set the bank’s interest rate on April 24, 2019.

The consensus among economists polled by Bloomberg is that the bank will stand pat again at that meeting, but trading in investments known as overnight index swaps suggests there’s about an eight per cent chance of the bank changing direction entirely and cutting its benchmark interest rate.

If it happens, it would be the first rate cut since 2015. Currency traders also seem to think a rate cut is now on the table.

The loonie lost about half a cent to 74.40 cents US when the decision came out. All things being equal, higher interest rates cause a country’s currency to increase in value, while lower interest rates cause the value to fall.