B.C.’s speculation tax increasing from 0.5% to 2% in 2020

The B.C. government has announced it is raising the Speculation and Vacancy Tax on Dec. 31 from 0.5 per cent to two per cent for foreign owners and for satellite families, the majority of whose income is not reported on a Canadian tax return.

Some new exemptions to the tax will be brought in while others currently in place will be phased out.

Stricter rules also coming for exemptions – The province says the $115 million in revenue collected from the speculation and vacancy tax goes toward affordable housing projects.

“When we introduced the Speculation and Vacancy Tax, our province was at the peak of a real estate crisis and moderation in the market was long overdue,” said Finance Minister Carole James.

Based on the data collected from the first year, the government says the tax is working as it was designed to — capturing speculators, foreign owners and people who own vacant homes.

The next phase of the tax brings:

- An exemption for property owners who are members of the Canadian Armed Forces while in active service and their spouses.

- An exemption for people who own properties which are only accessible by water.

- An end on Dec. 31, 2019, to the exemption for foreign owners of vacant land.

The exemption for empty strata properties in buildings where rentals are banned will be phased out by Dec. 31, 2021.

A strata title allows individual ownership of part of a property — generally either an apartment or townhouse — with shared ownership in the remainder of the building.

Under the new rules announced Tuesday, if the strata lot remains unoccupied, even if the building’s bylaws prohibit rentals, the tax will be levied.

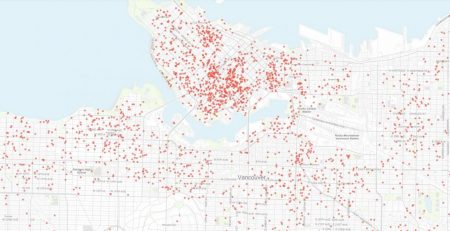

Introduced Dec. 31, 2018, the tax targets homes in the most populated areas of B.C. that are not declared as a primary residence or are not rented out for at least three months a year. More than 99 per cent of British Columbians are exempt.

“I recognize there are a variety of views on the Speculation and Vacancy Tax,” said James.

“There are those who oppose the tax and others who want to implement additional tax. I look forward to continuing discussions as we work together to tackle the housing crisis,” she said.