Property Watch: B.C’s 2020 real estate forecast is decidedly cloudy

[BC Business – December 19, 2019]

Will the market continue its rebound in 2020, or fall prey to a slowdown driven by rising supply? All bets are off.

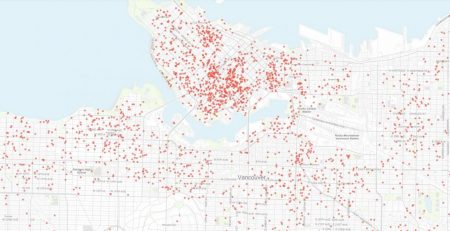

It’s been a whirlwind of a year for the B.C. housing market. Gossip about real estate, often considered British Columbians’ favourite pastime, quieted to a whisper at the start of 2019. Sales volumes reached six-year lows and prices began falling—a rare event for the 68 percent of B.C. residents who own a home, according to Statistics Canada.

But thanks to a slide in mortgage rates and an economy enjoying full employment, the market showed a return to form in the back half of the year, with sales nearing long-term historical averages. The question on everyone’s mind: Will this rally last? What can we expect heading into the new year?

Although I can’t forecast markets with precision, let’s apply some realistic probabilities to scenarios that could affect the outlook for B.C.’s housing market. Employment has been growing at an annualized pace of just over 4 percent, and as of September the provincial jobless rate tied Quebec’s for the lowest in the country. It appears that population growth will hover around historically normal levels and mortgage rates will remain very low, with banks more than willing to lend. If these tailwinds persist, they should help ensure a robust housing market.

But not all good things last forever. A decade into the current economic expansion, there are signs that the market is slowing, mostly due to a pullback of foreign investment, policy changes and indebted households plagued by wages that haven’t kept pace with home prices.

Because housing, construction and related finance account for nearly 25 percent of provincial GDP, the knock-on effects of a slower property market would be felt in the broader economy. There’s a real risk this could translate into job losses—the most significant danger now that the threat of rising interest rates has largely subsided.

There’s one other glaring risk: the record number of new housing units nearing completion. The 12-month sum has ramped up to all-time highs of nearly 40,000, the latest Statcan data show. Throw in a host of housing starts and near-record totals for units under construction, and we’re about to see a ton of new product, which thankfully should ease supply woes. Depending on the state of the labour market, this will help keep prices in check, or push them further down if unemployment and tighter credit weaken housing demand.

It looks like the odds of rising prices next year remain low, given where we are in the real estate cycle, with flagging sector employment and rising supply of new homes. Meanwhile, there’s still considerable risk of sluggish sales and lower prices if the provincial economy can’t shift away from this trend of slowing growth.

The tail wags the dog here in B.C. As housing goes, so does everything else. There will be plenty more to talk about in 2020.