Bank of Canada expected to cut mortgage rate to near record low

VANCOUVER (NEWS 1130) — Mortgage rates could near a record low as experts expect the Bank of Canada to cut its five-year mark as soon as this week.

CIBC and BMO both cut their five-year mortgage rates by 15 basis points earlier this week to 4.79 per cent.

The Canadian Mortgage Brokers’ Association expects an imminent cut to the benchmark five-year rate, as well. The Bank of Canada is expected to reduce the benchmark qualifying rate from 4.94 per cent to 4.79 this week

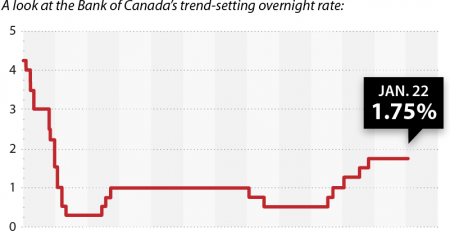

“This specific rate cut, if it happens, if it goes down to 4.79 — which, again, we are expecting — this would essentially be the closest to the all-time low that we’ve seen,” Reza Sabour, with the Canadian Mortgage Brokers Association of B.C., says of the potential rate cut.

“The all-time low was 4.64. That was in July of 2017. So this is just 15 basis points above that. So we are getting very close to the all-time low.”

‘Low rates until 2023’

Tiff Macklem, the new governor of the Bank of Canada, indicated about a month ago the intention is to purposely keep rates low until at least 2023.

“I think that announcement, in and of itself, was rather unprecedented, Sabour added. “We never saw the previous governor, Stephen Poloz, make forecasts that long ahead.”

Mecklem repaced Poloz in May.

Sabour said uncertainty remains due to COVID-19, but a rate cut could help buyers after a larger property.

“It can make the difference if you are on the fence between a property that you may just not qualify for versus this helping you just over the edge to qualify,” he added.

However, he doesn’t expect home prices to fall much.

‘Push demand higher’

Lower mortgage rates should push housing demand higher and protect prices, he said.

“Sometimes it can make a difference, even if it is just a few thousand dollars and you have a seller who’s not budging on their price,” Sabour added.

“Four to five-thousand dollars can still make a deal happen or fall apart, depending on the transaction.”

But with first-time buyers, he added, the question remains, how far are they willing to drive to qualify for a mortgage?

“And that’s always been the case, first-time buyers especially it seems they have to drive further and further out into the suburbs to be able to qualify for the space that they are wanting to get,” Sabour said.

“So often that creates a lot of disparity between where you have to actually work compared to where you have to actually live.”