Broken Supply Chains by Steve Saretsky

|

|||||||||

|

|||||||||

[Source: Global News, November 15, 2017] In B.C., a single realtor can currently represent both buyer and seller on a... read more

[Source: The Globe and Mail, March 2, 2017] Prices for condos and town homes are climbing in Greater Vancouver, despite... read more

[Source: REBGV, August 2, 2017] The Real Estate Board of Greater Vancouver (REBGV) reports that residential property sales in the... read more

[Source: Financial Post, January 17, 2017 British Columbia’s housing minister says a program to help first-time homebuyers received applications within... read more

[CTV - November 9, 2020] VANCOUVER -- A B.C. rent freeze that was put in place because of the COVID-19... read more

[Financial Post - January 12, 2021] TORONTO — Money markets see an increased chance of the Bank of Canada cutting... read more

[Source: Myedmondsnews -May 23, 2018] Sellers seem to have mixed reactions when they hear the word “staging.” Some go all-in,... read more

[CBC News - September 24, 2018] The world's biggest central bank is expected to raise rates this week — and... read more

[Source: DailyHive, February 20, 2018] Earlier today, British Columbia’s New Democratic Party (BC NDP) delivered its first provincial budget for... read more

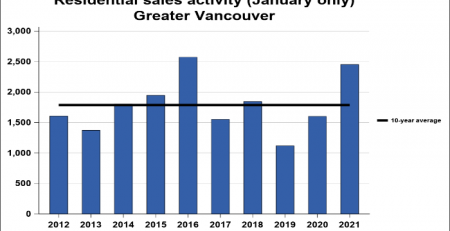

[CREA + REBGV - February 2021] In the first month of 2021, Metro Vancouver’s* housing market continued the pattern set at the end... read more