OSFI is reinforcing a strong and prudent regulatory regime for residential mortgage underwriting

[Source: OTTAWA – October 17, 2017 – Office of the Superintendent of Financial Institutions Canada]

Today the Office of the Superintendent of Financial Institutions Canada (OSFI) published the final version of Guideline B-20 − Residential Mortgage Underwriting Practices and Procedures. The revised Guideline, which comes into effect on January 1, 2018, applies to all federally regulated financial institutions.

The changes to Guideline B-20 reinforce OSFI’s expectation that federally regulated mortgage lenders remain vigilant in their mortgage underwriting practices. The final Guideline focuses on the minimum qualifying rate for uninsured mortgages, expectations around loan-to-value (LTV) frameworks and limits, and restrictions to transactions designed to circumvent those LTV limits.

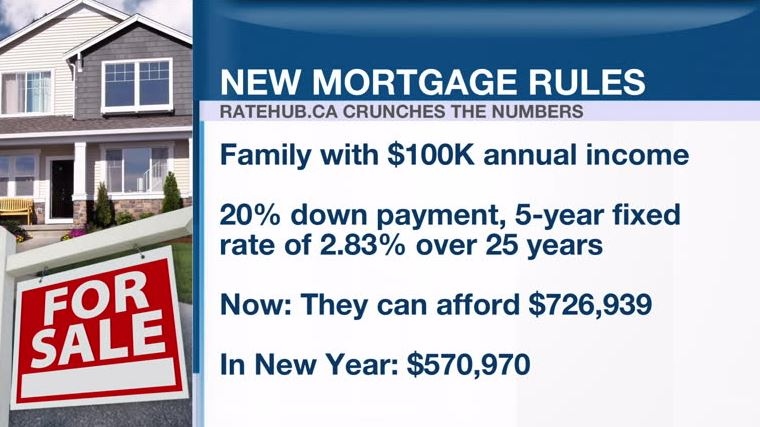

OSFI is setting a new minimum qualifying rate, or “stress test,” for uninsured mortgages.

Guideline B-20 now requires the minimum qualifying rate for uninsured mortgages to be the greater of the five-year benchmark rate published by the Bank of Canada or the contractual mortgage rate +2%.

OSFI is requiring lenders to enhance their loan-to-value (LTV) measurement and limits so they will be dynamic and responsive to risk.

Under the final Guideline, federally regulated financial institutions must establish and adhere to appropriate LTV ratio limits that are reflective of risk and are updated as housing markets and the economic environment evolve.

OSFI is placing restrictions on certain lending arrangements that are designed, or appear designed to circumvent LTV limits.

A federally regulated financial institution is prohibited from arranging with another lender a mortgage, or a combination of a mortgage and other lending products, in any form that circumvents the institution’s maximum LTV ratio or other limits in its residential mortgage underwriting policy, or any requirements established by law.

Quote: “These revisions to Guideline B-20 reinforce a strong and prudent regulatory regime for residential mortgage underwriting in Canada,” said Superintendent Jeremy Rudin.

Quick Facts: On July 7, 2017, OSFI published draft revisions to Guideline B-20 – Residential Mortgage Underwriting Practices and Procedures. The consultation period ended on August 17, 2017.

OSFI received more than 200 submissions from federally regulated financial institutions, financial industry associations, other organizations active in the mortgage market, as well as the general public.