Condo listings increase in Greater Vancouver but prices expected to remain flat over next two years

[The Georgia Straight – November 25, 2020]

Prices of condos have flattened since the start of the pandemic. Also, the supply of apartment units on the market is rising.

Economists have used these terms to describe what is happening with the condo sector.

These are accurate, according to Brendon Ogmundson, chief economist for the B.C. Real Estate Association, when asked for his read.

Is it time for sellers and condo owners to panic?

Not if one appreciates the economist’s historical analysis of the condo market and the main conclusion he draws.

“It means fairly flat pricing in probably the next two years,” Ogmundson told the Straight in a phone interview.

For starters, he noted a “divergence” in housing sales in Greater Vancouver, depending on the type of home.

To clarify, “Greater Vancouver” is the region serviced by the Real Estate Board of Greater Vancouver (REBGV). The area includes Vancouver, Burnaby, Coquitlam, Maple Ridge, New Westminster, North Vancouver, Pitt Meadows, Port Coquitlam, Port Moody, Richmond, South Delta, Squamish, the Sunshine Coast, West Vancouver, and Whistler. In October and through the first half of November, Ogmundson said, sales of single detached homes are up between 30 percent and 40 percent on a year-over-year basis. The same goes for townhouses. For condos, the growth is about 10 percent.

“Apartments are certainly lagging behind other product types,” the economist said.

Regarding the rising supply of condos waiting for buyers, Ogmundson said that in the REBGV region, there are about 6,000 active listings.

“The last that we were in a recession, we had 8,000,” he said, referring to the 2008-09 global financial crisis.

Considering the present economic environment amid the COVID-19 pandemic, and compared to the last recession, current listings for condos “just aren’t that high”, Ogmundson said.

Moreover, listings are comparable to where the market was between 2010 and around 2015, before demand started to rise.

According to Ogmundson, listing levels of apartments hit a “historical low” from 2015 to 2018.

“While listings are definitely up,” the economist said about the current situation, “they’re not up to a concerning level.”

Ogmundson said that prices for condos in the REBGV region peaked in 2018 and started to trend down in 2019.

“On a longer scale, we have these peaks and valleys for apartment prices,” he said, “and right now, we kind of had a recovery going on right until the pandemic started, and prices are just flat.”

For next year, Ogmundson expects supply of new condos to come to the market and help meet fresh demand.

“Demand should recover pretty strongly through 2021 and after that,” he said.

This means condo prices will be “essentially flat through 2021”, Ogmundson explained.

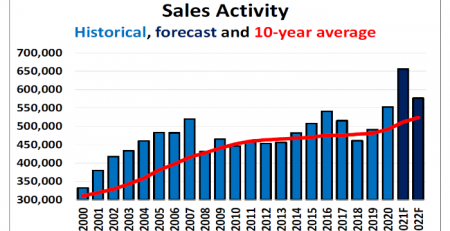

On November 4 this year, Ogmundson and the BCREA released their fourth-quarter forecast suggesting that record-low mortgage rates and a recovering economy will continue to drive sales.

The projection noted that “active listings remain low due to hesitation on the part of sellers to list during the pandemic”.

“Some additional supply may come online following the end of mortgage deferral programs, but given the tightness of market conditions, that supply is unlikely to be disruptive,” the forecast stated.

The BCREA predicted overall home sales in 2020 to finish at 90,450 units, up from the 77,350 transactions recorded in 2019.

With a “strong momentum heading into 2021”, sales are projected next year to rise to 99,240 units.

Meanwhile, the average price of a home in B.C. is forecast to finish 2020 with a 9.9 percent increase, followed by another rise of 2.6 percent in 2021.

As for condos in the REBGV region, sales of apartment units are anticipated to total 14,500 in 2020, an improvement from the 12,468 sales in 2019. In 2021, apartment sales are projected to rise further, to 15,600.

In 2019, the average price of a condo in Greater Vancouver came to $660,594. For 2020, it is expected to finish the year at $685,000. A modest rise is anticipated for 2021, with the average price increasing to $690,000.