Foreign ownership registry a game changer in B.C. say real estate insiders

[Globe and Mail – December 9, 2020]

Recent government action to force transparency of property ownership in B.C. had outspoken immigration lawyer Richard Kurland so impressed that he fired off a letter to the Premier.

“It’s game over. It’s huge,” Mr. Kurland says. “It means you can’t hide international capital in B.C. real estate. And it’s about gosh darn time, because there were so many players who benefitted from being blind … including individuals who were able to hide capital, to hide profits from the tax authorities of Canada and their home countries.”

According to the province, the Land Owner Transparency Registry, which came into effect on Nov. 30, is the first in the world to require ownership disclosure of land that is owned by corporations, partners and trustees – also known as beneficial ownership.

It is one action among several that have been taken over the past couple of years to bring transparency, combat domestic and international tax evasion and money laundering, and make living in B.C. more affordable by encouraging property owners to rent out their properties instead of keeping them vacant, Mr. Kurland said in his e-mail to Premier John Horgan. B.C. is leading the way with unique measures designed to close system loopholes and bring housing back to the local market.

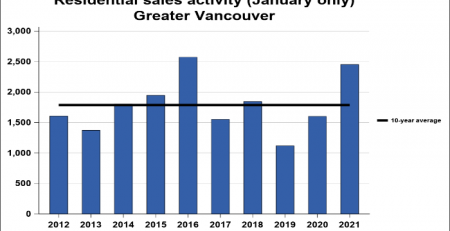

Mr. Kurland believes that the registry was so significant that its Nov. 30 launch played a major role in driving the currently hot property market in Metro Vancouver. Buyers were eager to make purchases under the cloak of beneficial ownership before the registry came into effect, he says.

B.C., said Mr. Kurland, is the “intentional guinea pig” for all housing markets disrupted by the inflow of global wealth. The new registry means the government will finally know who owns what, and hold those owners accountable for their fair share of taxes. If owners don’t comply, the land title won’t be registered.

Mr. Kurland has for many years been studying the role of foreign money in the Vancouver market and the resulting exclusion of local income earners from home ownership, also known as the “decoupling” of incomes from housing.

The registry is the most recent move among a long list of measures designed to quell untaxed foreign money that had flowed into the Lower Mainland real estate market over the past decade with scant oversight, accountability or traceability. Tax laws that had been designed to protect local citizens had not been enforced. Data had not been collected to support policies that would end loopholes in the system. The Canadian Housing Statistics Program (CHSP), which has been churning out data for the past two years, changed that.

Andy Yan, director of Simon Fraser University’s city program, says the CHSP finally provided meaningful numbers on the extent of non-resident ownership in B.C. and Ontario.

“One of the stunning statistics it just discovered was how 17 per cent of recently built condos in the city of Vancouver were owned by at least one owner who did not live in Canada,” Mr. Yan says.

The other game changer was the Speculation and Vacancy Tax that, importantly, required a declaration of income taxes being paid in Canada. The SVT is a 2-per-cent annual surtax on homes owned by either foreign nationals or satellite families. A satellite family is a household that is earning more than 50 per cent of their income outside Canada. The government, and Canada Revenue Agency, can now cross-reference who’s paying income tax, and therefore who qualifies for capital gains tax exemptions, Mr. Kurland says.

The province has credited the tax for helping to drive home prices down 5.6 per cent in the first quarter of 2019. B.C. also charges foreign owners a 20-per-cent property transfer tax and the city of Vancouver has its own Empty Homes Tax of 1.25 per cent on properties left empty for half the year. The city of Toronto announced last week that it is looking at a vacant home tax to increase housing supply.

Also last week, the federal Liberal government announced as part of its fiscal report a proposal for its own foreign buyer’s tax, in an effort to help local buyers get into the housing market. Jason Turcotte, vice-president of development for Cressey Development Group, said such a tax would hurt markets dependent on foreign dollars, such as Whistler ski resort, which has a large American demographic.

“A blanket tax over an entire country is certainly not the way to go when each individual province and city has its own acute market needs,” Mr. Turcotte said.

But such efforts to manage the influx of foreign real estate investment are particularly attractive as part of the economic recovery effort, their supporters say.

“The need now is to appear to be doing something to address economic hardship, post COVID,” Mr. Kurland says. “And you want to stabilize, if not lower the numbers, on the property market to assist young people, because that’s who gets hit by rising property prices.”

The question that governments have long needed to ask, says Mr. Kurland, was simple: Did you or did you not file a Canadian income tax return? Those homeowners who answered “No,” would be liable to a mandatory withholding tax on the proceeds of any sale. That, he says, was not being enforced. Untaxed profits were being recirculated throughout the housing market, putting local income earners at a disadvantage.

“Imagine you are a foreign national, and you are not supposed to have a capital gains exemption for your principal residence. … But you say that you live in Canada, and so you don’t pay any tax on the profit. And then you can’t bring that profit back to China, so you don’t report the profit to China. You don’t report the profit to Canada, and so now you have a lot of money. So what do you do with it? You buy another property. I wanted to put a stop to that.”

Simon Fraser University school of public policy assistant professor, Josh Gordon, recently released a paper that made use of new CHSP data and examines the phenomenon of Metro Vancouver areas that have high property prices, very low incomes and a high percentage of foreign ownership or non tax-residency. He’s a big supporter of the SVT, but he would like to see the removal of an exemption that is given to the foreign owner for renting out all or part of the property, which he sees as defeating the purpose of the tax. Removal of the exemption, he argues, would put pressure on foreign owners to either sell or pay the annual surtax, which would either put properties back into the local market or generate tax revenue for public benefit.

“Suppose you have a wealthy foreign owner who owns a single detached house who enjoys the land price appreciation over time – and who isn’t paying Canadian income taxes, but who is a landlord, and therefore exempt from the SVT. Why do we need foreign landlords for that kind of property?”

There remains room for improvement, Mr. Kurland adds. The system still has its loopholes.

“The province of B.C., and other provinces, do not like the fact that a small minority of these immensely wealthy families are technically living under the poverty line in multimillion-dollar homes, and entitled to GST credits, child tax credits, and you name it. But the [dollar] numbers don’t present a business case to do anything about it.”

But with the recent push by the province for more transparency, “the wall,” he says, “has been cracked.”