What’s the Average Value of a New Mortgage in Vancouver?

[Source: REW, August 8, 2017]

Number of new mortgages across Canada and in BC rose in 2016, CMHC reports – but Vancouver loan amounts decrease.

With Greater Vancouver home prices increasing exponentially each year and now at record highs, there is a widespread – and understandable – assumption that most buyers must be taking out huge mortgages to afford real estate in the region.

However, the average value of a new mortgage loan in the Vancouver Census Metropolitan Area (CMA) in 2016 was just $438,716, according to a report released August 8 by the Canada Mortgage and Housing Corporation.

That’s less than the average of $477,268 in 2015 and $463,248 in 2014 – standing roughly level with 2013 averages.

This decline could be partially explained by the drop in the value of pricey single-family homes seen in the latter part of 2016 after the foreign buyer tax was introduced. However, with the largest proportion of new mortgages going to first-time buyers – who generally enter home ownership at the cheaper end of the market, in which prices kept rising in 2016 – the decline in loan amounts cannot be entirely attributed to the detached-home price drop.

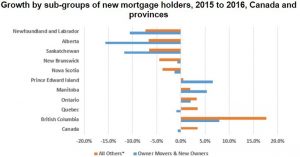

CMHC reported, “BC and Ontario recorded growth in almost all types of mortgage categories, with refinances being among the fastest growing category in both provinces. All of British Columbia’s CMAs recorded very strong double-digit growth in refinance activity and large increases in the number of consumers with multiple mortgages.”

The report added, “The growth in refinanced loans in Vancouver and Toronto and their surrounding areas implies that existing homeowners are leveraging larger amounts of home equity” – which could also partially explain the decline in Vancouver’s average new mortgage loan value.

The numbers told a different story in Victoria, where the average value of a new mortgage in 2016 increased to a record $370,431 – up from $362,404 in 2015.

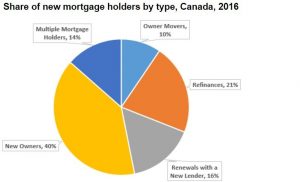

The nationwide study found that, across Canada, there were just over one million new mortgages taken out last year, a 1.4% rise over 2015. Of these, nearly 40% were lent to new home owners, and nearly 10% to owners moving to a new home.