OSFI is reinforcing a strong and prudent regulatory regime for residential mortgage underwriting

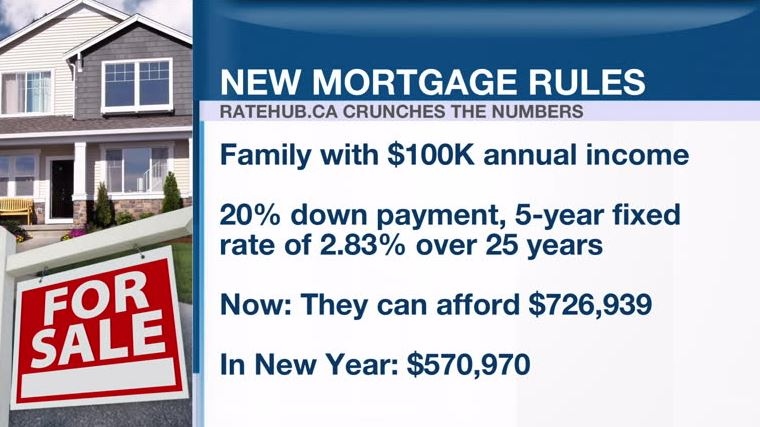

[Source: OTTAWA - October 17, 2017 - Office of the Superintendent of Financial Institutions Canada] Today the Office of the Superintendent of Financial Institutions Canada (OSFI) published the final version of Guideline B-20 − Residential Mortgage Underwriting Practices and Procedures. The revised Guideline, which comes into effect on January 1, 2018, applies to all federally regulated financial institutions. The changes to Guideline B-20 reinforce OSFI’s expectation that federally regulated mortgage lenders remain vigilant in their mortgage underwriting practices. The final Guideline [...]